Everyone everywhere starts with The One.

One Life is our church-wide Kingdom Builders journey to inspire us to live and give beyond ourselves. No matter where we are in our personal walks with Christ, He’s always encouraging and inspiring each of us to take our next step and do our part in reaching the one. Together, we’ll grow in our relationship with God and build our faith as we look beyond where we are to the place He’s calling us to go.

Our Stories.

As Christians, we are tasked with sharing the good news-which means we are called to also share the good news of what the Lord has done in our lives so that, perhaps, our story can reach the heart of someone else who needs to know that there is a hope that is promised.

Josh

Jen

Stephen

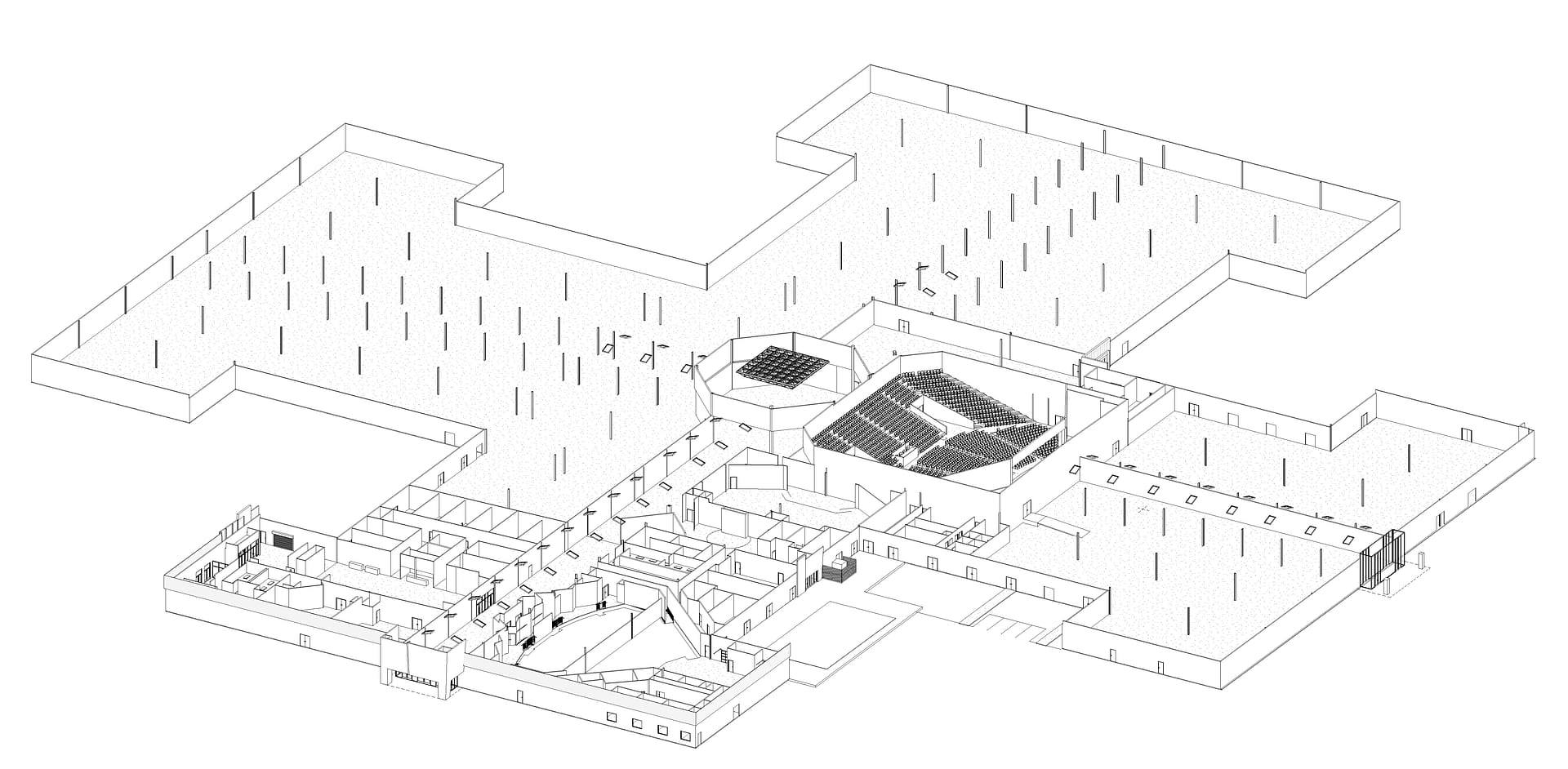

Project Overview

- Expand the auditorium to 1600 seats

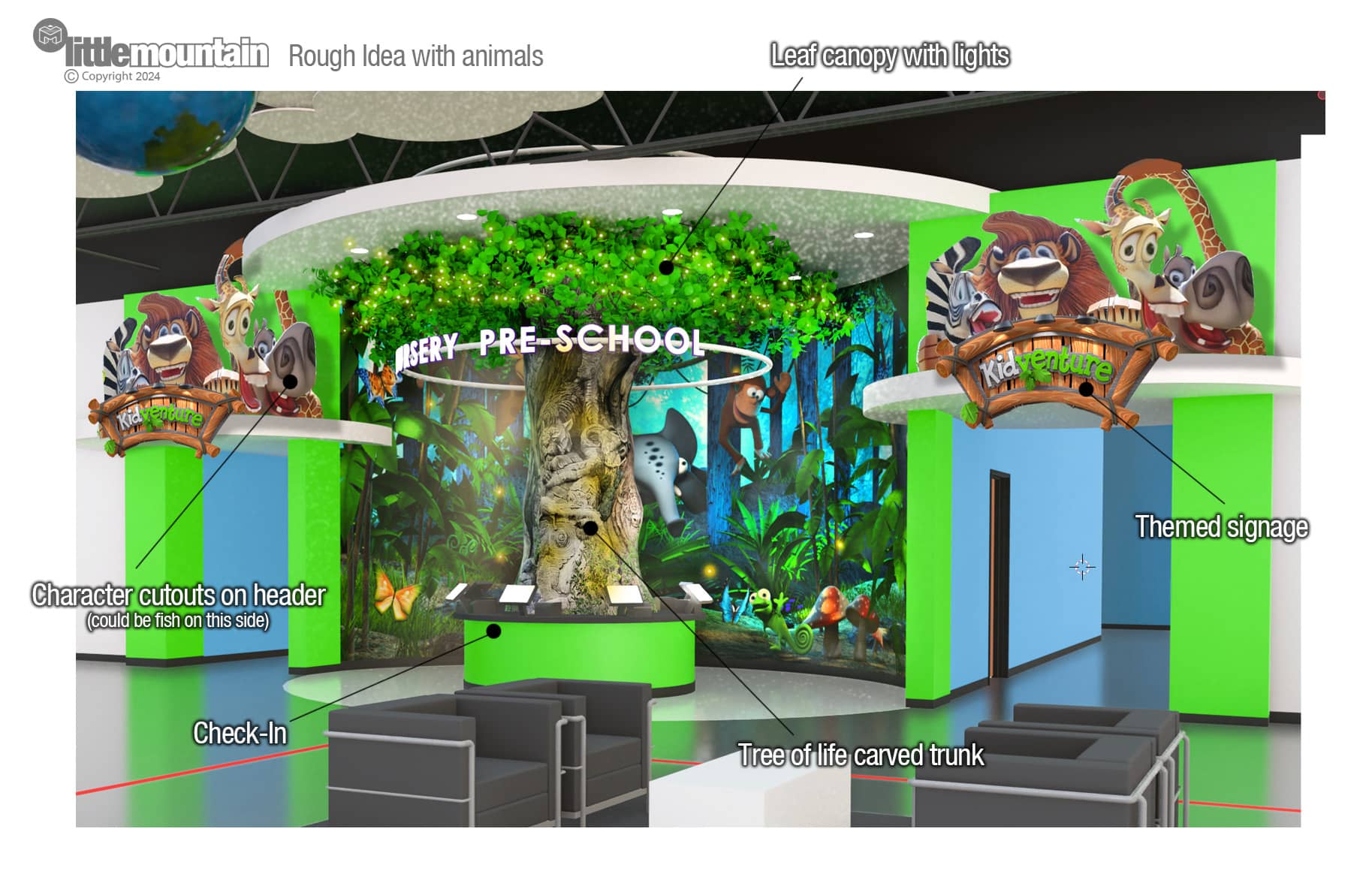

- Upgrade Kids Area

- Renovate the Youth Area at All Locations

- Launch Daycare and Preschool

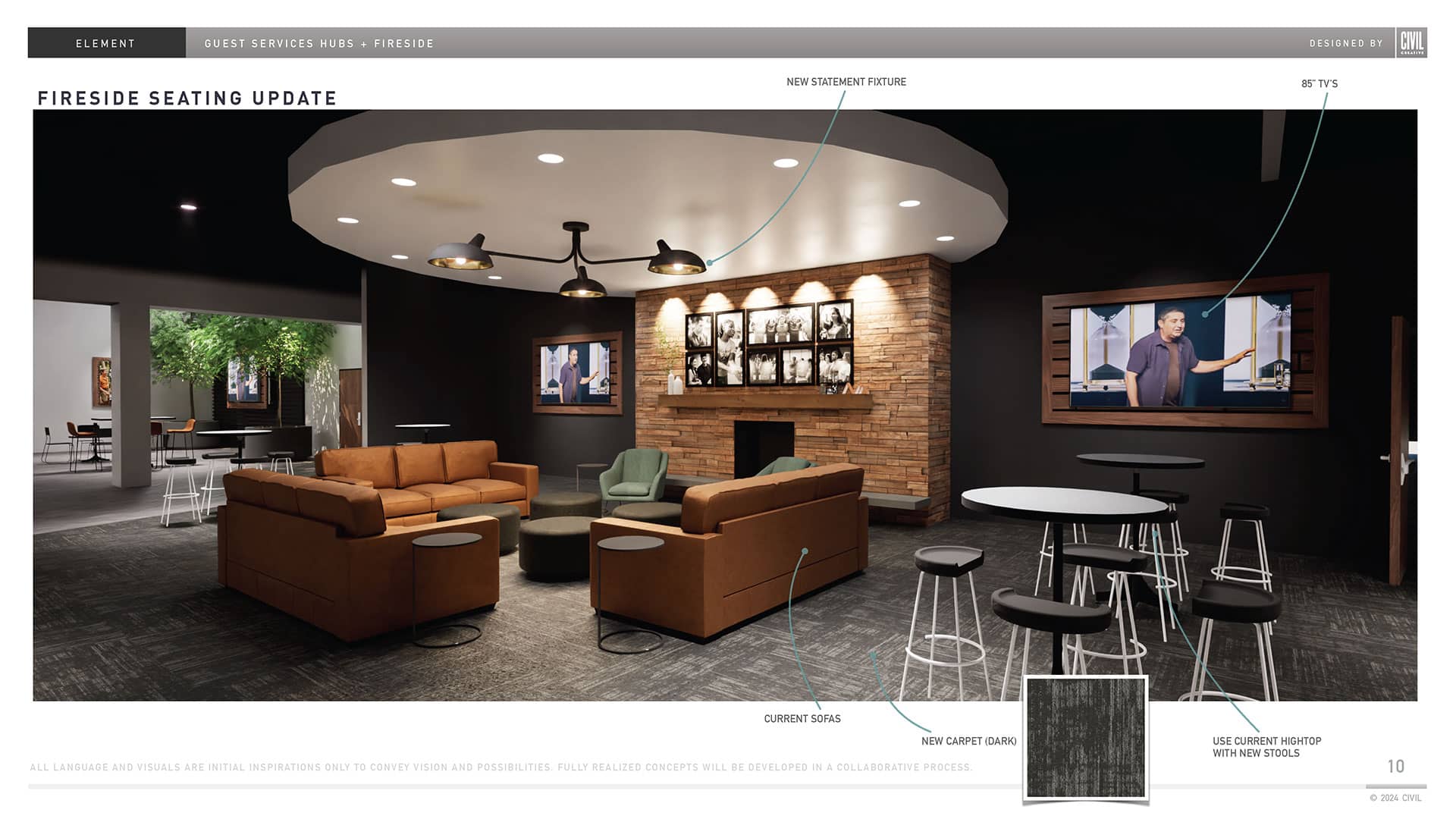

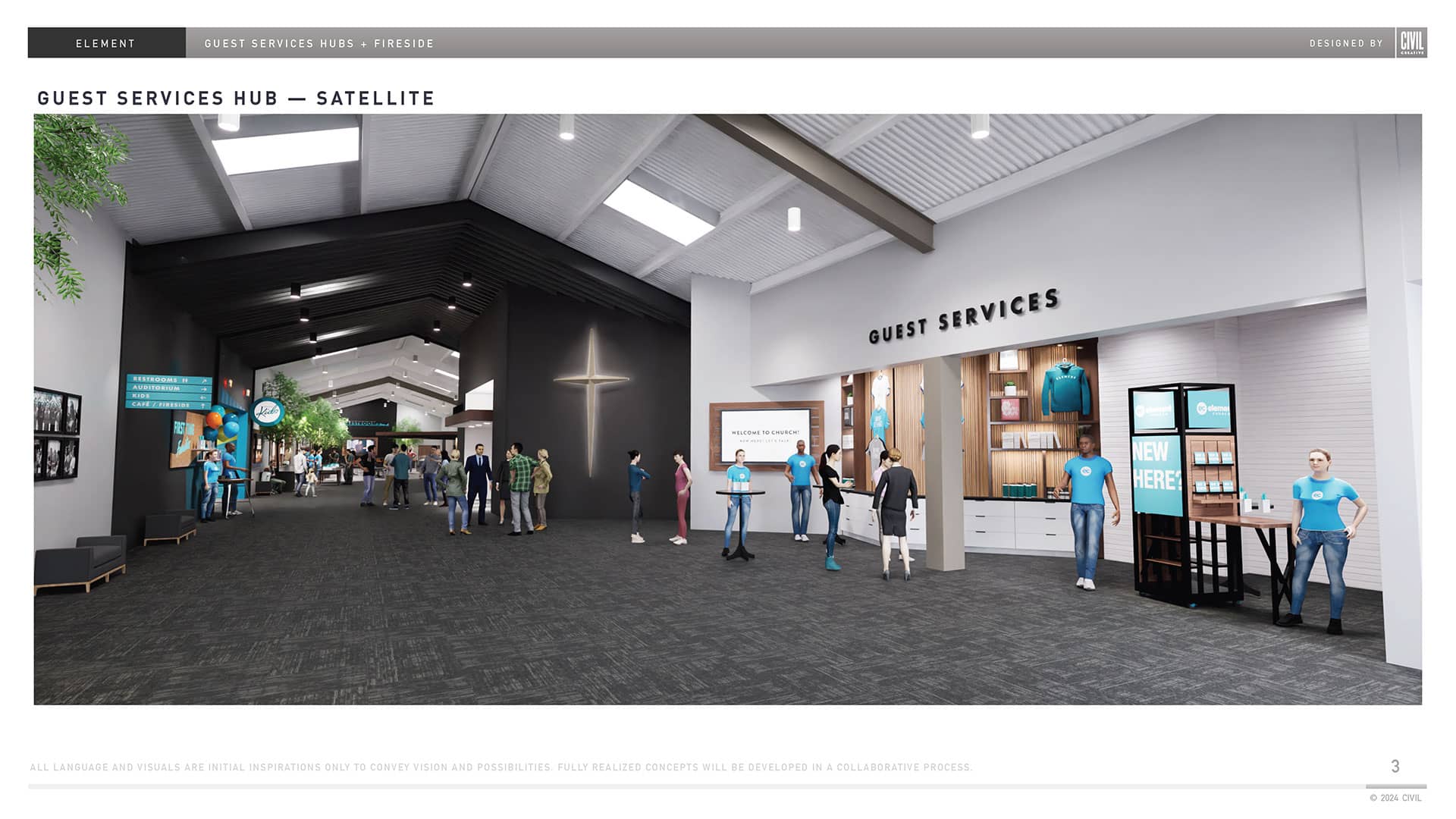

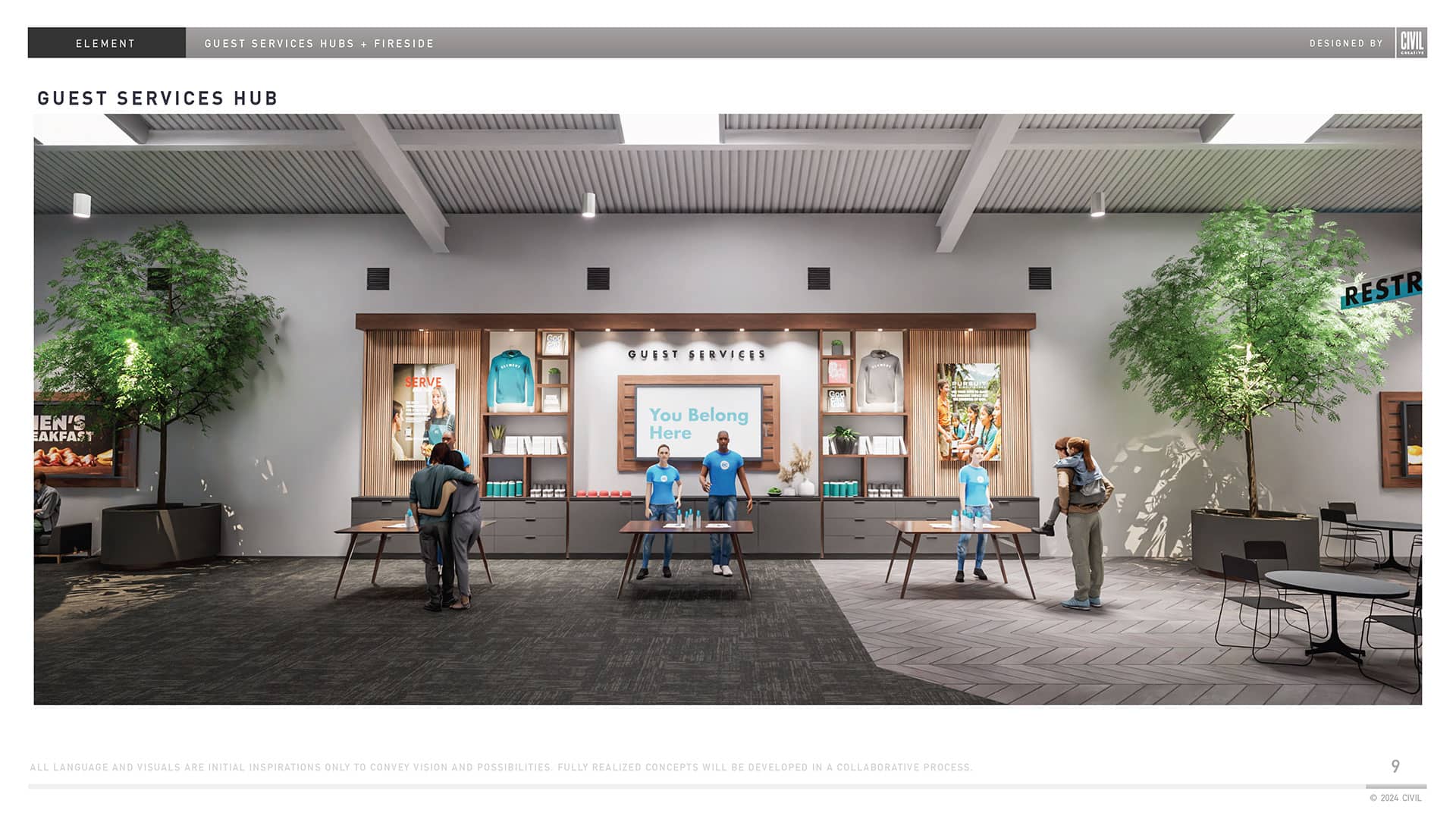

- Expand Gathering Space and Café

Looking for more info? We’ve got you covered. Download our digital PDF.

Project Need.

With the steady growth of our congregation, we are finding ourselves at capacity. However, there are still adults, students, and kids who need Jesus and a church-home like Element. So, simply saying “we’re full” is not an option. We want to continue providing space to reach the one. One Life begins in 2025 with the goal of raising $10M to fund the project and begin utilizing the new spaces by 2027.

PHASE 1

$2.5M Raised

Kids Area Buildout Begins

PHASE 2

$5M Raised

Auditorium Buildout Begins

PHASE 3

$8M Raised

Youth Area Remodel Begins

PHASE 4

$10M Raised

Project Completion

Creative Ways to Give.

Stocks and Bonds

Donating appreciated securities can be a tax-efficient way to support a charity. You can transfer ownership of stocks or bonds directly to the organization, potentially avoiding capital gains taxes.

Real Estate

You can donate property, such as land or buildings. This can be a significant contribution, and like stocks, it may provide tax benefits. Just be sure to consult with a tax advisor regarding any implications.

Mutual Funds

Similar to stocks, you can donate shares of mutual funds to a nonprofit. This also allows you to avoid capital gains taxes on appreciated shares.

Cryptocurrency

If you hold cryptocurrency, many nonprofits now accept donations in this form. It can also help you avoid capital gains tax.

Life Insurance Policies

You can name a charity as the beneficiary of your life insurance policy or transfer ownership of an existing policy to the nonprofit.

Retirement Accounts

Naming a charity as a beneficiary of your retirement accounts (like IRAs or 401(k)s) can help you leave a legacy while potentially minimizing tax burdens for your heirs.

Trusts

Set up a charitable trust that allows you to donate assets while retaining some benefits, like income from those assets during your lifetime.

Professional Services

Offering your professional skills (like consulting, legal advice, or creative services) can be invaluable, effectively acting as a donation of time and expertise.

Ready to Give?